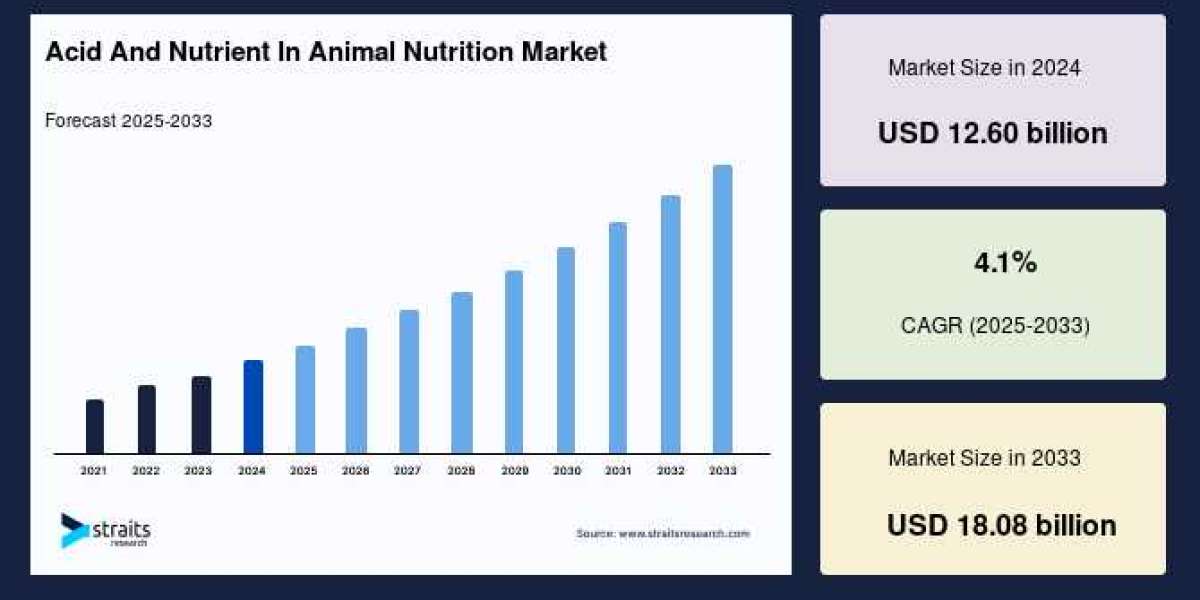

The global acid and nutrient in animal nutrition market size was valued at USD 12.60 billion in 2024 and is projected to reach from USD 13.11 billion in 2025 to USD 18.08 billion by 2033, registering a CAGR of 4.5% during the forecast period (2025-2033).

Drivers Fueling Market Growth

The fundamental impetus behind the growth of this sector is the increased global consumption of animal protein such as meat, milk, and eggs, spurred by population growth and rising disposable incomes. As the global population was estimated to exceed 8 billion by 2024, the demand for sustainable and efficient animal protein production has never been higher. Livestock producers are shifting toward advanced nutrition practices that incorporate specialized acids and nutrients to improve feed efficiency, animal health, and product quality, thus meeting consumer expectations for safety and nutrition.

Particularly, poultry production has experienced significant growth, driven by the need for affordable and healthy meat alternatives. Advanced feed formulations enriched with acids and essential nutrients support digestive health, immune function, and overall performance in poultry, contributing to sector expansion. Similarly, ruminants such as cattle and sheep benefit from tailored nutrient blends that optimize rumen health and enhance milk and meat yields.

Product Segmentation and Importance

Among the various acid and nutrient types, amino acids hold a dominant market share due to their critical roles in protein synthesis, muscle development, and metabolic regulation. Essential amino acids must be obtained through diet, underscoring their importance in animal feed formulations for improved growth and reproduction.

Minerals such as calcium, phosphorus, magnesium, zinc, and iron are indispensable for bone development, enzyme functionality, and neurological health in animals. Deficiencies in these minerals can lead to impaired productivity and reproductive challenges, making their precise inclusion in animal nutrition vital for performance optimization.

Organic acids and acidifiers also play a strategic role by promoting beneficial gut microbiota, enhancing nutrient absorption, and reducing the need for antibiotics. This aspect aligns with the increasing global focus on antibiotic stewardship and sustainable farming practices.

Regional Market Dynamics

Asia-Pacific stands as the largest regional market shareholder due to the significant scale of animal feed production in countries like China, India, and Japan. Continuous modernization of feed mills, rising grain production, and the consolidation of the livestock industry have propelled growth in this region. For example, China’s industrial feed output increased substantially in recent years, and India’s feed output showed strong growth rates, reflecting burgeoning animal husbandry sectors.

North America, characterized by the presence of leading global feed manufacturers and frequent product innovations, is the fastest-growing market region. Major players introduce novel feed additives that improve palatability and health outcomes, driving competition and market expansion.

Europe also showed significant growth potential due to its high meat and dairy consumption, stringent feed additive regulations, and growing preference for high-quality, nutrient-rich animal feed formulations.

Regulatory Landscape and Market Challenges

The animal nutrition sector operates under stringent regulatory frameworks designed to guarantee the safety, efficacy, and quality of feed additives. Regulations in regions such as the European Union, India, and the United States impose comprehensive safety assessments, labeling requirements, and product approvals to protect animal and human health. Adhering to these regulations can be challenging for market players but also encourages innovation and transparency in the sector.

Despite optimistic growth prospects, the market faces several challenges. The high cost of premium feed ingredients can be prohibitive for small and medium-sized farms, limiting access to high-quality nutrition. Additionally, volatility in raw material prices due to geopolitical tensions and climatic impacts disrupts supply chains and feed formulation consistency.

Future Opportunities and Trends

Technological advancements offer promising avenues for enhancing acid and nutrient delivery in animal feed. Precision livestock farming, utilizing IoT devices, artificial intelligence, and big data analytics, allows for real-time monitoring and optimized nutrition management tailored to individual animal needs. This drives feed efficiency and animal welfare improvements while reducing waste.

Consumer preferences increasingly favor sustainable and ethically sourced animal products, stimulating demand for natural and organic feed additives. Companies innovating with eco-friendly acidifiers, prebiotics, and probiotics stand well-positioned to capture emerging market share while aligning with environmental stewardship goals.

The focus on gut health, illustrated by rising consumer health consciousness notably among younger generations, aligns with the use of acidifiers and prebiotics in animal nutrition to support beneficial microbial balance. This holistic approach enhances disease resistance, nutrient uptake, and overall productivity in livestock.

Conclusion

The acid and nutrient in animal nutrition market is set on a transformative growth trajectory driven by rising global demand for quality protein, evolving animal husbandry practices, and growing regulatory oversight. The integration of advanced nutritional additives, regional market dynamics, and technological innovation underpin a vibrant industry landscape. As the sector navigates challenges related to cost and supply chain stability, opportunities in precision feeding, sustainable practices, and gut health optimization will define the future of animal nutrition, ultimately supporting global food security and livestock welfare.