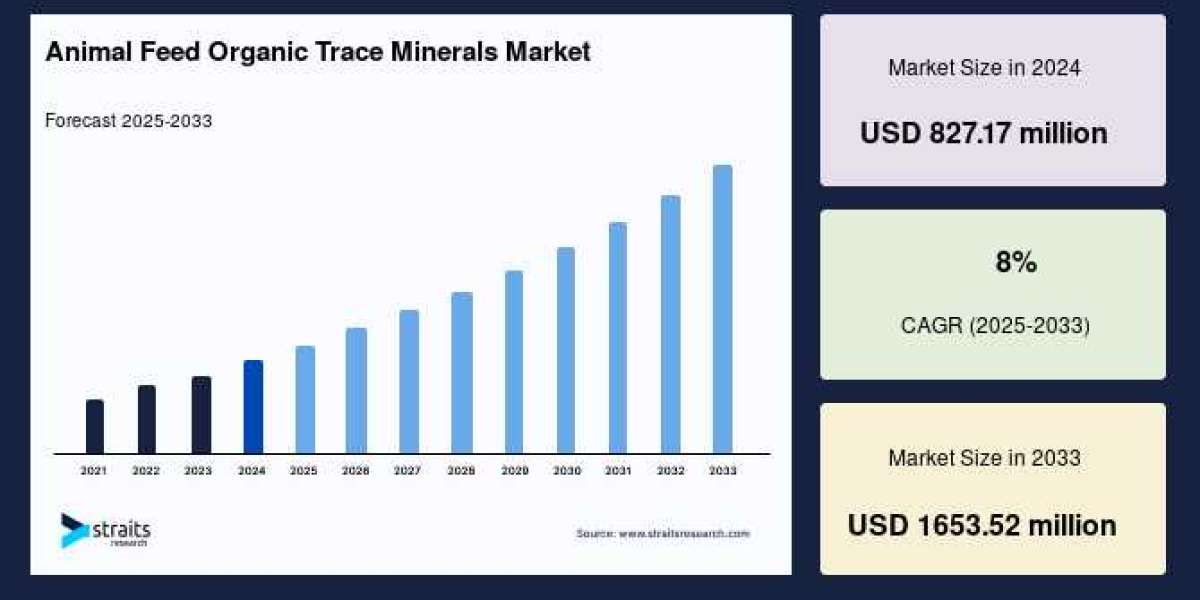

The global animal feed organic trace minerals market size was valued at USD 827.17 million in 2024 and is projected to reach from USD 893.35 million in 2025 to USD 1653.52 million by 2033, registering a CAGR of 8.0% during the forecast period (2025-2033).

Organic trace minerals micronutrients such as zinc, copper, iron, manganese, selenium, and cobalt play an essential physiological role in animals. These minerals are vital for numerous functions including growth, immune support, reproduction, and metabolism. Unlike their inorganic counterparts, organic trace minerals are bound to organic molecules like amino acids or peptides, which enhances their bioavailability, absorption, and utilization by animals. This biochemical advantage ensures animals' optimal health and productivity, which is becoming increasingly important as global demand for animal-derived proteins rises.

Drivers of Market Growth

Several broad trends are driving the adoption of organic trace minerals in animal feed. First and foremost, the global population growth, urbanization, and rising incomes are boosting demand for meat, dairy, and eggs. According to forecasts by the Food and Agriculture Organization (FAO), global per capita meat consumption is projected to continue increasing, with poultry consumption accounting for a significant share of this rise. The trend is especially pronounced in the Asia-Pacific region, which currently commands the largest market share. Growing middle classes in countries such as China, India, Malaysia, and Thailand are shifting dietary preferences toward higher protein intake, driving demand for improved livestock nutrition solutions.

Second, environmental and health concerns related to inorganic mineral supplementation are encouraging a switch to organic trace minerals. Inorganic forms of minerals often contribute to environmental contamination through fecal excretion of unused minerals, raising concerns about soil and water pollution. Organic trace minerals, with their higher absorption rates, mitigate this problem by reducing mineral waste and enhancing sustainability in animal farming.

Third, the rising consumer preference for organic and naturally sourced animal products is impacting feed formulations. Consumers looking for healthier, safer, and environmentally responsible food are boosting demand for organically certified animal products, which require compliant organic trace minerals in feed. This consumer-driven push is reflected in the expanded retail availability of organic meat, dairy, and eggs, which in turn fuels the animal feed industry's growth in organic additives.

Market Segmentation and Applications

Among organic trace minerals, zinc holds the largest market share, accounting for about 35% of revenues. Zinc is critical for immune function, metabolism, growth, and reproductive health in animals. Organic forms like zinc methionine offer better bioavailability, helping to improve growth rates and overall health, particularly in young animals. Other important minerals include iron, which is essential for oxygen transport and energy metabolism, and copper, which enhances egg fertility and skeletal development.

The poultry segment dominates the application front, representing roughly 45% of market revenues. Poultry feed often incorporates organic trace minerals to support rapid growth, egg production, bone strength, and immune health. The high demand for poultry meat and eggs, driven by expanding consumption in lead markets such as China and the United States, is a major factor contributing to this market dominance. Swine production is another significant application area, where organic trace minerals improve growth, reproduction, and meat quality, especially critical as pig farming faces challenges from diseases such as African swine fever.

Other livestock sectors, including dairy cattle, beef, aquaculture, and pet food, are also substantial contributors to market growth as producers focus on enhancing animal health, feed efficiency, and product quality.

Regional Insights

Asia-Pacific is the largest regional market, projected to grow at a CAGR close to 8% due to the presence of major manufacturers and the expanding meat industry. China leads the region in demand, with rapid economic growth and rising meat consumption fueling feed innovations. The Asia-Pacific region is expected to account for more than half of the global meat trade by 2030, underscoring the critical role organic trace minerals will play in its livestock sector.

North America is another vital market, driven by stringent regulatory frameworks, consumer demand for organic products, and innovation in animal nutrition. Companies such as Archer Daniels Midland, Alltech, and Cargill lead in supplying organic trace minerals. Regulatory bodies like USDA promote organic feed supplements through certification, supporting market expansion.

Europe, while experiencing slower meat production growth compared to other regions, has significant consumer interest in organic and natural foods influencing feed formulation choices. Sustainability and animal welfare concerns in the EU continue to support demand for organic trace minerals in animal feed.

Challenges and Opportunities

Despite steady market growth, the industry faces challenges including raw material scarcity for organic ligands and chelating agents used in mineral supplementation. Amino acids and peptides needed for mineral chelation can be limited and costly, contributing to price volatility and supply chain disruptions. Additionally, competition for these raw materials from human nutrition, pharmaceuticals, and cosmetics sectors can tighten supply.

Nevertheless, these challenges also present opportunities for technological advancements such as precision chelation and mineral microencapsulation to improve bioavailability and cost efficiency. The development of AI-driven digital feed formulation platforms is poised to standardize optimal supplementation, further enhancing productivity.

Additionally, the growing ban on antibiotic growth promoters in livestock feed in many regions propels organic trace minerals as a natural alternative to support animal health and immune function, presenting fertile ground for market growth.

Future Outlook

The animal feed organic trace minerals market is poised to sustain strong growth throughout the next decade. With increasing focus on sustainable farming, animal welfare, and consumer-driven demand for organic protein products, the adoption of organic trace minerals will remain crucial. Market players are expected to invest in research and development to address raw material challenges and improve cost-effectiveness.

As the global demand for animal protein continues to rise, organic trace minerals represent a key nutritional innovation that supports the productivity and health of livestock while addressing environmental and consumer concerns. This market is set to become an indispensable segment of the animal feed industry, delivering both economic and ecological benefits.