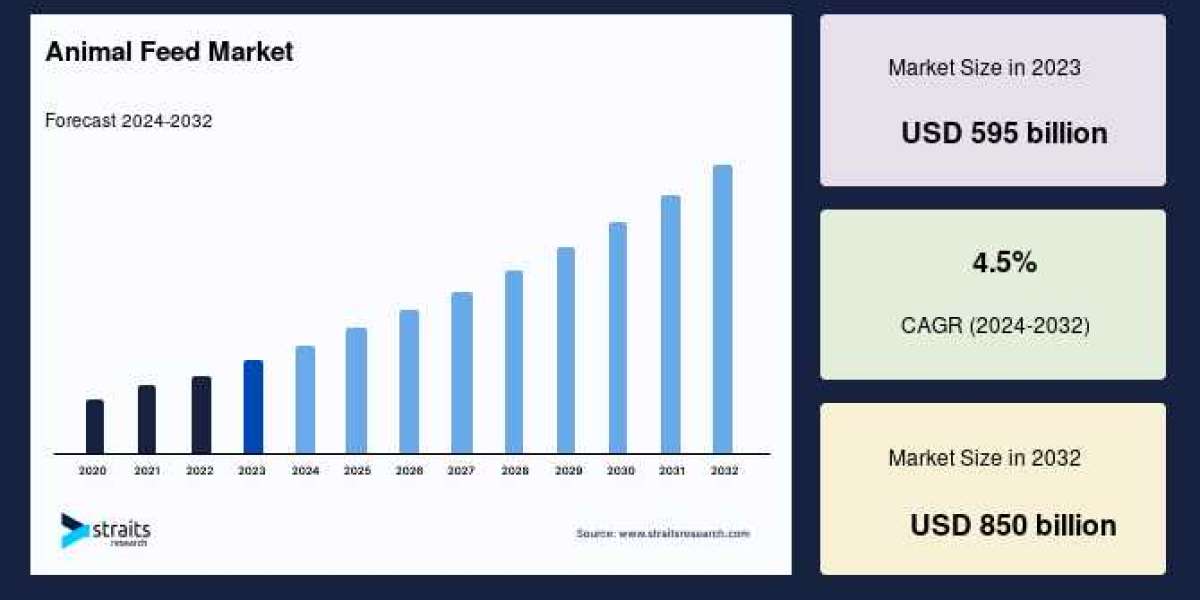

The global animal feed market is witnessing steady expansion, driven by growing demand for animal protein, advancements in feed formulation technologies, and rising global population. Valued at approximately USD 595 billion in 2023, the market is projected to reach USD 850 billion by 2032, growing at a compound annual growth rate (CAGR) of about 4.5% over the forecast period. This article explores the major factors fueling growth, key regional dynamics, market segmentation, challenges, and future opportunities in the animal feed industry.

Market Overview and Growth Drivers

Animal feed is a specialized type of nutrition designed to meet the dietary needs of livestock, poultry, aquaculture, and pets. Providing essential nutrients like proteins, carbohydrates, lipids, vitamins, and minerals, animal feed plays a crucial role in supporting growth, reproduction, and overall health of animals. The rising global population and increasing demand for meat, dairy, and other animal-based products are primary drivers elevating the animal feed market.

Technological innovations are also influencing market expansion. Advances in feed formulation allow precise nutrition tailored to species, growth stages, and production goals, leading to better feed conversion ratios and reduced wastage. Modern aquaculture and livestock farming increasingly rely on optimized feeds to maximize productivity and sustainability. Implementation of environmental initiatives targeting reductions in resource use and emissions further support the demand for efficient feeding solutions.

Regional Dynamics

Asia-Pacific: Largest Market Share

Asia-Pacific stands out as the most significant market for animal feed, driven by rapid urbanization, rising incomes, and extensive agricultural activity. Countries like India and China are major contributors, with increasing consumption of protein-rich diets encouraging livestock growth. The diverse agricultural landscape supports a variety of feed components tailored for different crops and animals. Technological integration and digitalization in feed production enhance supply chain efficiency and contribute to innovation.

North America: Fastest Growing Region

North America is projected to witness the fastest growth in the animal feed market. The region benefits from a well-established livestock industry, abundant raw material supplies such as maize and dextrose, and stringent meat quality regulations. Consumer health consciousness and rising per capita meat consumption further fuel demand. The United States plays a crucial role due to NAFTA agreements facilitating feed ingredient trade and its large-scale cattle industry.

Europe and Other Regions

Europe holds the second-largest market share, influenced by its strong animal husbandry and feed manufacturing sectors. Germany leads in market dominance within Europe, while the UK shows rapid growth. Interest in novel feed products and government investments in sustainable agriculture spur demand. Other regions like Latin America and the Middle East also show growth owing to expanding livestock sectors and increasing focus on feed quality and safety.

Market Segmentation

By Animal Type

Poultry: The largest segment, propelled by demand for affordable, low-fat protein sources like chicken and eggs. Poultry farming growth globally supports this dominance.

Cattle: Significant due to dairy and meat production demand. Rising bovine populations correlate with high milk output in populous nations.

Swine, Aquaculture, Pets: These segments are also expanding steadily, with aquaculture benefiting from modernization and pets driven by premiumization trends in pet food with natural ingredients and specialized health benefits.

By Ingredient and Form

Cereals: Dominating as a primary energy source, cereals provide carbohydrates essential for livestock growth and performance.

Feed Additives: Fastest growing segment. Additives improve nutritional content, animal health, and feed efficiency while supporting sustainable farming practices.

Plant-based and Animal-based Ingredients: Plant-based ingredients are valued for cost-effectiveness and sustainability. Animal-based proteins like fish and blood meal provide crucial nutrients, especially for monogastric animals like pigs and poultry.

Pellets: Most widely used feed form, appreciated for easy storage, nutrient density, and convenience in handling.

Dry Forms and Oral Powders: Emerging segments gaining traction due to shelf life, ease of use, and effectiveness of delivering nutrients and medications.

By Production and Manufacturing

Feed manufacturers dominate the supply chain by producing feeds tailored to different species. Contract manufacturing is growing rapidly, optimizing production efficiency and offering customized feed solutions to meet specific market needs.

Challenges

The market faces hurdles such as the prevalence of low-quality or counterfeit feed products, which can harm animal health, reduce productivity, and disrupt supply chains. Ensuring quality and safety standards remains a priority to maintain farmer trust and consumer confidence. Additionally, balancing cost-efficient production with environmental sustainability is a constant challenge.

Opportunities and Future Outlook

Investment in research and development is a key growth opportunity, enabling innovations in feed ingredients, formulation techniques, and alternative protein sources such as insects. These advances promise to improve feed efficiency, reduce environmental impact, and meet the rising global demand for animal-based food products sustainably. The growing pet food segment also offers avenues for expansion with premiumized, natural, and specialized diets.

Sustainability continues to influence market trends, with increasing adoption of eco-friendly processes and ingredients. Digital tools and precision nutrition further propel the industry toward optimized feeding regimes tailored to individual farm requirements.

Conclusion

The animal feed market is poised for steady growth driven by population growth, rising consumption of animal protein, and technological advancements in feed production. Asia-Pacific remains the largest market, while North America is the fastest growing. Segmentation by animal type, ingredient, and feed form reveals diverse and evolving consumer needs. Challenges around feed quality and sustainability are actively addressed through innovation and regulation, setting the stage for a dynamic and resilient animal feed industry over the coming decade.