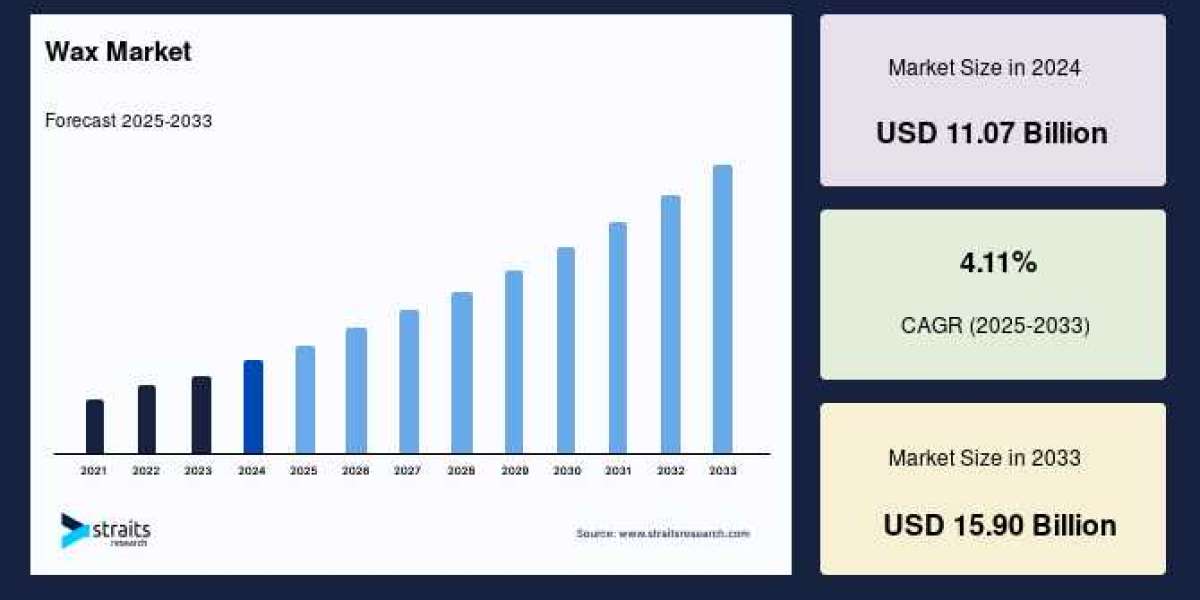

The Wax Market Size was valued at USD 11.07 Billion in 2024. It is projected to reach from USD 11.52 Billion by 2025 to USD 15.90 Billion by 2033, growing at a CAGR of 4.11% during the forecast period (2025–2033).

Understanding Wax and Its Types

Wax is a versatile group of organic compounds that remain solid at room temperature and melt above 40°C. Characterized by long aliphatic chains, waxes are hydrophobic and insoluble in water but dissolve easily in nonpolar organic solvents. They are widely categorized into mineral waxes, natural waxes, and synthetic waxes:

Mineral waxes such as paraffin, microcrystalline, petrolatum, and ceresin are derived from petroleum and coal byproducts. Microcrystalline waxes particularly offer diverse physical and thermal properties, facilitating their use in adhesives, cosmetics, and food applications.

Natural waxes include animal- and plant-based varieties. Animal waxes encompass beeswax, lanolin, and tallow wax, while plant-based waxes include soy, carnauba, and candelilla waxes. These waxes are prized for attributes like water repellency, chemical resistance, and biodegradability.

Synthetic waxes are engineered to provide enhanced stability, scratch resistance, and chemical tolerance. They are increasingly preferred in newer applications such as textiles, coatings, and inks given their customizable properties.

Market Drivers and Applications

The robust demand for wax is propelled by its superior properties such as UV resistance, moisture repellency, anti-caking capabilities, and excellent insulation. These qualities translate into extensive use across multiple industries:

Candles represent one of the largest segments in the wax market. The rising popularity of scented, decorative, and eco-friendly candles for home décor and aromatherapy fuels wax consumption. Candles come in various forms including pillars, tapers, jar candles, and tealights, serving diverse consumer preferences.

Packaging Industry greatly leverages paraffin and synthetic waxes for coated corrugated boxes, enhancing water repellency and durability. The rapid growth of packaging, especially in developing nations, contributes significantly to wax demand.

Rubber and Plastics sectors use wax as processing aids to improve mechanical properties, curing times, and lubrication in manufacturing operations like mixing and calendaring.

Cosmetics and Personal Care extensively employ wax in products like lip balms, lotions, and haircare items. The increasing consumer inclination toward natural, clean-label ingredients has boosted demand for natural waxes in this space.

Adhesives, Inks, and Coatings industries increasingly adopt synthetic waxes for their slip, anti-blocking, and mar-resistance properties, which improve product performance and processing efficiency.

Regional Insights and Growth Opportunities

Asia-Pacific Leading the Market

Asia-Pacific dominates the wax market due to rapid industrialization, growing packaging, cosmetics, and adhesive industries, and abundant availability of raw materials. Countries such as China and India are at the forefront, benefiting from low labor costs and increasing manufacturing capabilities. Moreover, Southeast Asian nations such as Indonesia and Malaysia are emerging as important production hubs due to favorable economic growth and skilled labor pools.

Europe: Fastest Growing Region

Europe is expected to experience significant growth, driven by stringent environmental regulations promoting low-PAH (polycyclic aromatic hydrocarbons) paraffin waxes and a strong presence of cosmetic and personal care companies. Innovations in edible coatings for fresh produce and increased adoption of biodegradable waxes align with sustainable consumption patterns, accelerating market expansion.

North America and Latin America

In North America, the wax market benefits from niche applications such as fire logs, anti-oxidant additives for tires, and water-repellent composites in construction. The region’s well-established personal care and cosmetics industries further bolster wax demand. Latin America’s growth is linked to expanding plastics, rubber manufacturing, and construction sectors, especially in countries like Brazil, Argentina, and Chile.

Market Challenges

While growth prospects are strong, the wax industry faces challenges primarily related to raw material price volatility, especially petroleum derivatives like paraffin and microcrystalline waxes. Fluctuating crude oil prices can adversely impact production costs and profitability. Additionally, stringent regulatory environments, particularly in Europe, may limit usage or impose higher compliance costs on manufacturers.

Technological Innovations and Trends

Ongoing RD efforts focus on developing bio-based and sustainable wax alternatives that offer similar or enhanced performance to traditional waxes. Advances in synthetic wax formulations are enabling applications in high-performance coatings and specialty adhesives. Furthermore, the surge in e-commerce has stimulated demand for wax-coated packaging materials that improve product protection and sustainability.

Future Outlook

The global wax market is poised for steady advancement fueled by growing end-use sectors and environmental considerations. Synthetic waxes are expected to gain traction due to their customizable properties and enhanced stability, while the rising consumer preference for natural and biodegradable products will propel demand for natural wax variants. The packaging and cosmetics industries are anticipated to remain key drivers, supported by technological improvements and evolving consumer lifestyles.

As expanding industrial activities, especially in emerging economies, sustain wax demand and new applications continue to emerge, stakeholders in the wax value chain can anticipate a dynamic market environment with ample opportunities for innovation and growth over the next decade.