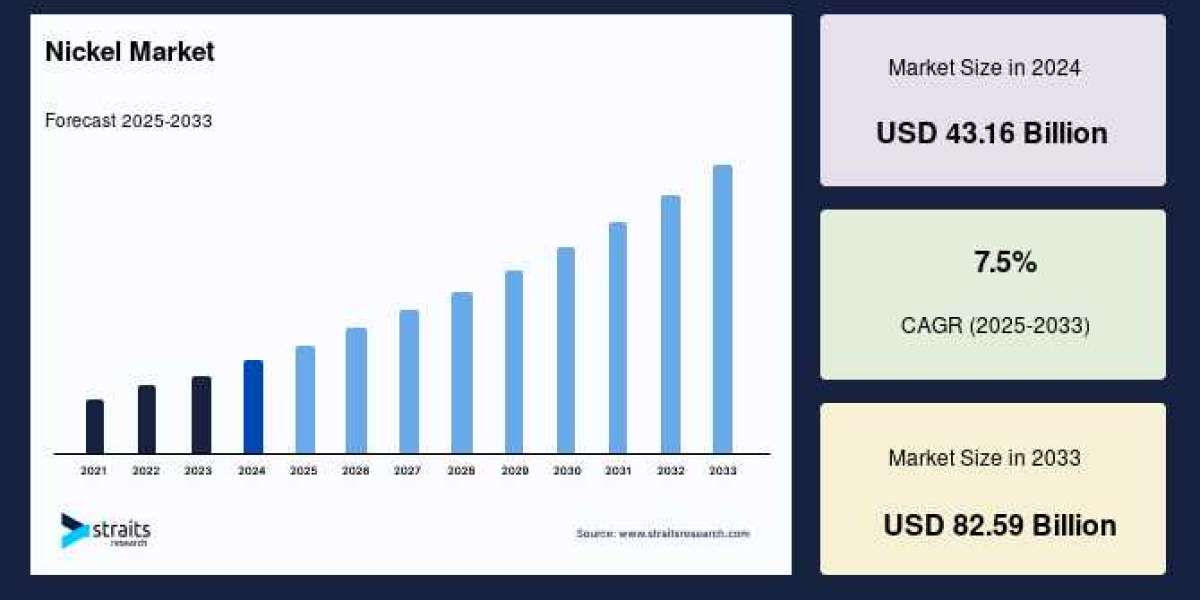

The global nickel market size was valued at USD 43.16 billion in 2024 and is expected to grow from USD 46.39 billion in 2025 to reach USD 82.59 billion in 2033, growing at a CAGR of 7.5% over the forecast period (2025 – 2033).

Market Fundamentals and Production Dynamics

Nickel, a lustrous, corrosion-resistant metal essential for stainless steel, battery technologies, and high-performance alloys, is primarily sourced from two ore categories: laterites and magmatic sulfides. Global production surged notably in recent years, with Indonesia emerging as a dominant player. Indonesia's expanding mining and refining capacity, including investments in "green nickel" production methods such as high-pressure acid leaching (HPAL), has contributed to an oversupply that suppresses prices in the near term.

The International Nickel Study Group projects a primary nickel output of approximately 3.735 million tonnes in 2025, surpassing demand, which is estimated at 3.537 million tonnes. This surplus, around 198,000 tonnes, continues a trend of excess supply observed over previous years. Concurrently, countries rich in nickel reserves like the Philippines and Russia play key roles in shaping market supply alongside Indonesia's ascendancy as a processing hub due to export bans on raw ore.

Demand Drivers and Sectoral Trends

Stainless steel production remains the backbone of nickel demand, accounting for nearly 70% of global consumption. Nickel's properties enhanced corrosion resistance, strength, and durability make it indispensable across construction, automotive, industrial machinery, and consumer appliances. Rapid industrialization and infrastructure development in emerging economies such as China, India, and Indonesia underpin steady demand growth for stainless steel and, by extension, nickel.

The electric vehicle (EV) battery segment is rapidly gaining traction as a critical growth area, supported by nickel-rich lithium-ion battery chemistries like Nickel-Manganese-Cobalt (NMC) and Nickel-Cobalt-Aluminum (NCA). These batteries benefit from nickel's high energy density, boosting EV range and performance. As companies such as Tesla and CATL scale battery production, the demand for high-purity Class I nickel used in battery manufacturing is rising, projected to grow at approximately 5.7% in 2025.

However, nickel demand from EVs is somewhat constrained by the growing adoption of lithium-based batteries that require less or no nickel, softening what might otherwise be an even more robust growth curve. Moreover, the expiration of U.S. federal EV tax incentives in 2025 has temporarily dampened demand momentum in that key market.

Market Volatility and Price Outlook

Price volatility has been a defining feature of the nickel market. After a dramatic spike to over $45,000 per metric ton during geopolitical upheavals in 2022, nickel prices moderated significantly to a subdued range of around $15,000 per metric ton by mid-2025. This moderated pricing reflects the interplay of oversupply and demand uncertainties.

Major analysts anticipate nickel prices will hover in a tight band between $15,500 and $16,000 per metric ton through 2025, with only brief rallies triggered by supply disruptions or policy changes. The market is unlikely to return to structural equilibrium before 2030, reflecting production outpacing demand and softer EV battery uptake.

Sustainability and Recycling: The Emerging Paradigm

Sustainability is reshaping nickel market dynamics, with increasing emphasis on environmental impact and circular economy principles. "Green nickel" produced using lower-carbon methods and renewable energy is gaining favor, especially for EV battery applications recognized for their critical role in decarbonization.

Nickel recycling initiatives are expanding rapidly, recovering the metal from stainless steel scraps and spent EV batteries. This approach not only mitigates supply risks and price fluctuations but also aligns with tightening environmental regulations and corporate sustainability goals. Firms like Glencore and Umicore are pioneering advanced recycling technologies, bolstering nickel's role in a more sustainable industrial ecosystem.

Regional Market Insights

Asia-Pacific dominates the nickel landscape, driven by the largest consumer, China, responsible for more than half of global nickel demand. China's extensive stainless steel production and accelerating EV battery manufacturing capacity fuel this leadership. Indonesia’s strategic investments in nickel processing infrastructure further consolidate the region’s importance.

Europe is the fastest-growing market, propelled by aggressive climate policies, such as the European Green Deal and carbon neutrality targets for 2050. European nations like Germany, Norway, and France lead the charge toward electric mobility and renewable energy integration, fueling demand for nickel-rich batteries. Investments in gigafactories and raw material partnerships enhance the region’s battery supply chain resilience, amplifying its nickel market significance.

Industry Innovation and Strategic Expansion

Nickel's versatile use in high-performance alloys, such as Ni-chromium, underpins applications in aerospace, automotive, and renewable energy sectors. The adoption of cutting-edge manufacturing technologies, like 3D printing, is expanding the use of nickel alloys in complex, critical components.

Market leaders and emerging players alike are responding to shifting demand patterns by scaling production capabilities, optimizing mining operations, and investing in cleaner refining technologies. Companies are pursuing strategic partnerships and mergers to diversify their product portfolios and geographic reach, focusing heavily on battery-grade nickel essential to energy transition technologies.

One notable player, Tsingshan Holding Group, headquartered in China, has rapidly established itself as a major stainless steel and nickel products supplier, servicing multiple industries including aerospace and automotive, reflecting the sector’s integrated industrial value chain.

Conclusion

The nickel market is at a pivotal juncture. While projections forecast robust long-term growth driven by stainless steel and EV battery demand, the immediate outlook for 2025 is characterized by oversupply, price pressure, and market recalibration. Sustainability imperatives and technological innovation are key themes shaping the sector’s evolution, with recycling and "green nickel" production set to redefine supply dynamics.

As the global economy advances toward electric mobility and renewable energy, nickel will remain an essential metal. Its strategic importance across industries and regions will ensure steady demand growth, ultimately leading to tighter supply balances and price recovery by the end of the decade. Stakeholders across the value chain must navigate this complex environment with agility and foresight to capitalize on nickel’s critical role in the future industrial landscape.